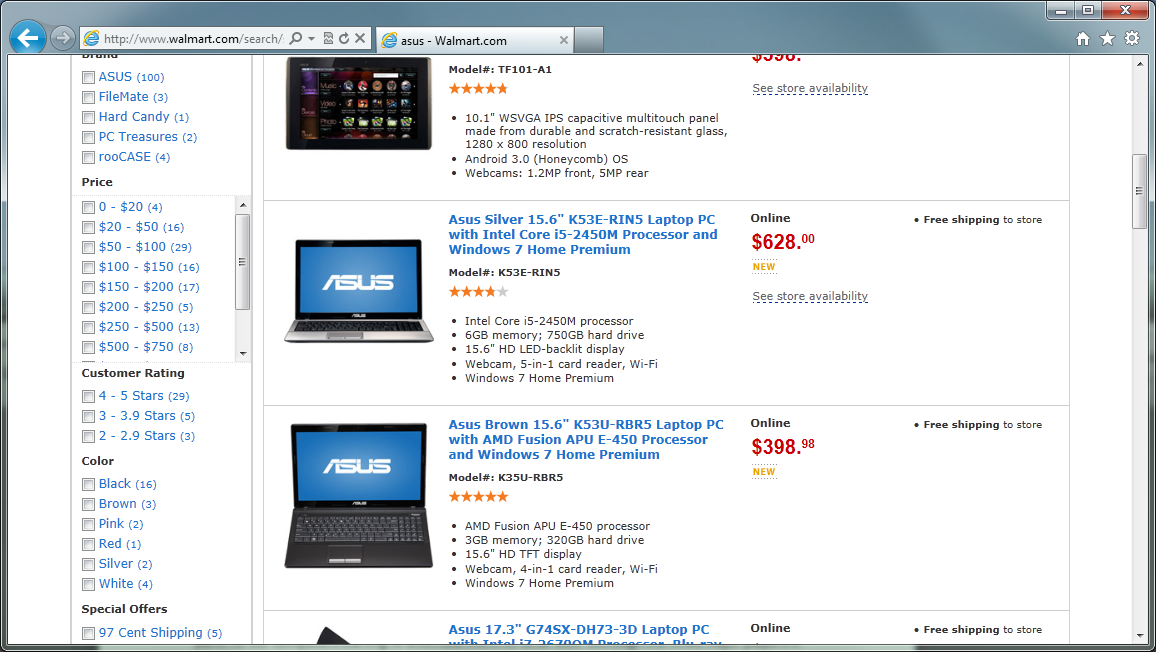

To give you an idea of what I mean let’s take a look at the notebook market. Asus has managed to break into not only stores such as Best Buy, but also Target and Wal-Mart. If you search for Asus at Wal-Mart.com you get a rather long listing of Asus products headed up by their Transformer Tablet. The same search for MSI yields one 14-inch notebook and a lot of separate components while Gigabyte shows no systems at all. Meanwhile a search for Asus at Traget.com gives you their current line-up of tablets and a lot of batteries for their note and netbooks.

The reason for this is that Asus has their own large-scale assembly and manufacturing company (Pegatron). This allows them to be a one stop shop (almost their own independent channel) for all of their products. Asus designs them, builds them and ships them all within the same family of companies. This is in contrast to Foxconn which concentrates on manufacturing more than component design and marketing (although they do still have their own line of products).

Gigabyte and MSI also have manufacturing and assembly plants, but for the most part they have either operated as an ODM (original design manufacturer) or have made these products in limited numbers due to cost. MSI for example has been an ODM for servers and laptops for some time. It has only been relatively recently that they have begun to sell their own branded products (and they still are not a major presence in the US). Gigabyte is also an ODM but on a smaller scale than either MSI or Asus (although they have been making server boards for Intel for some time).

What really gives Asus that upper hand here is their manufacturing capabilities, Pegatron is a large manufacturer big enough that even Apple uses them. They have facilities to really push out their products on a larger scale than MSI or Gigabyte can at this time. Asus also has better consumer market confidence which all started with the EEE PC. They have a couple of years head start on the competition.

After speaking with both MSI and Gigabyte about their market penetration in North America and in particular the US they both acknowledge that it is hard to compete with the likes of Dell, HP, Acer and others. This is despite some bad press that all three companies have gotten in the past and the good reputation these companies have for components.

I suppose by now you are wondering where I am going with all of this, well when a company like Asus gets to the size they are they have to expand into new markets or risk stagnation. The DIY market has been shrinking and while there is still enough of a demand from consumers and the boutique dealers it cannot be the main portion of any companies business model. Asus has been making desktops for some time now, but they have never been a major push (not to mention that most have not been very powerful) and there is almost no penetration in North America. We have a feeling that this is going to change very soon. Asus has launched a new ROG gaming system which has some very nice specifications. It is very possible that Asus will begin pushing into the North American market with this type of system as traditionally the gamers and PC enthusiasts have the most income to spend (or are at least willing to spend more). At the point they launch this business in the US they will only lack a readily available enterprise line in order to begin competing with HP and Dell head to head.

We know that Asus makes servers and networking hardware, but outside of the consumer line they do not directly sell these to the public. We imagine that it is only a matter of time before we see Asus begin to push into competition with Dell, HP, Acer and a few other companies right in their own back yard. All of the pieces are in place they really just have to make the announcements. They already have a successful component, consumer networking, mobile (notebooks, netbooks and tablets), and a solid channel sales department; there really is not much left to do.

If our guess is correct we feel the next step will be a round of desktop reviews in the normal press channels followed by sales in some of their existing package store partners. In fact I would not be surprised to see some of these hit the Internet in Q2 just to get their name in everyone’s mind for Q3 sales and the back to school push.

Discuss this in our Forum

Editorials

Is Asus planning to be the next Dell or HP?

- Details

- By Sean Kalinich

- Hits: 5435

Every now and then we like to step back and take a look at the component industry. It has not been that long ago when the number of individual component makers began to dwindle. We have already watched as ABIT, SOYO DFI, FIC, and other motherboard manufacturers have disappeared. These were once great companies and flourished in the heyday of the DIY market (the Super Socket 7, Slot A and 1, Socket A etc.). Now the market is collapsing and we see companies that once only directly sold the pieces and parts for our computers starting to assemble them for us as well. Although the three major players in the motherboard/GPU market all have presence in Europe and Asia only one has truly penetrated the North American market and stands poised to make an even bigger impact there; this is Asus.

Every now and then we like to step back and take a look at the component industry. It has not been that long ago when the number of individual component makers began to dwindle. We have already watched as ABIT, SOYO DFI, FIC, and other motherboard manufacturers have disappeared. These were once great companies and flourished in the heyday of the DIY market (the Super Socket 7, Slot A and 1, Socket A etc.). Now the market is collapsing and we see companies that once only directly sold the pieces and parts for our computers starting to assemble them for us as well. Although the three major players in the motherboard/GPU market all have presence in Europe and Asia only one has truly penetrated the North American market and stands poised to make an even bigger impact there; this is Asus.