AMD chose to have the main briefing on Kyoto only yesterday (5-28-2013) which was a little unusual, but not that much of a concern if you consider what most people were already guessing about the new APU. This turned the briefing into more of a positioning statement with details on how the Operton X specifically fits into market (although there was plenty of information about the specifications of the Opteron X). The briefing was led by Andrew Feldman, former CEO of SeaMicro and head of Data Center Services Division at AMD and he wasted no time in setting up expectations and establishing what we should take away from the briefing.

From the statement shown below, AMD is looking to go after Intel’s Atom quickly to establish the Opteron X as the better choice in terms of efficiency and power. This is not a bad idea as AMD does need to get back into competing with Intel head to head like they have in the past, and the server market is an excellent place to do this as companies start changing their ideas on the way the datacenter runs.

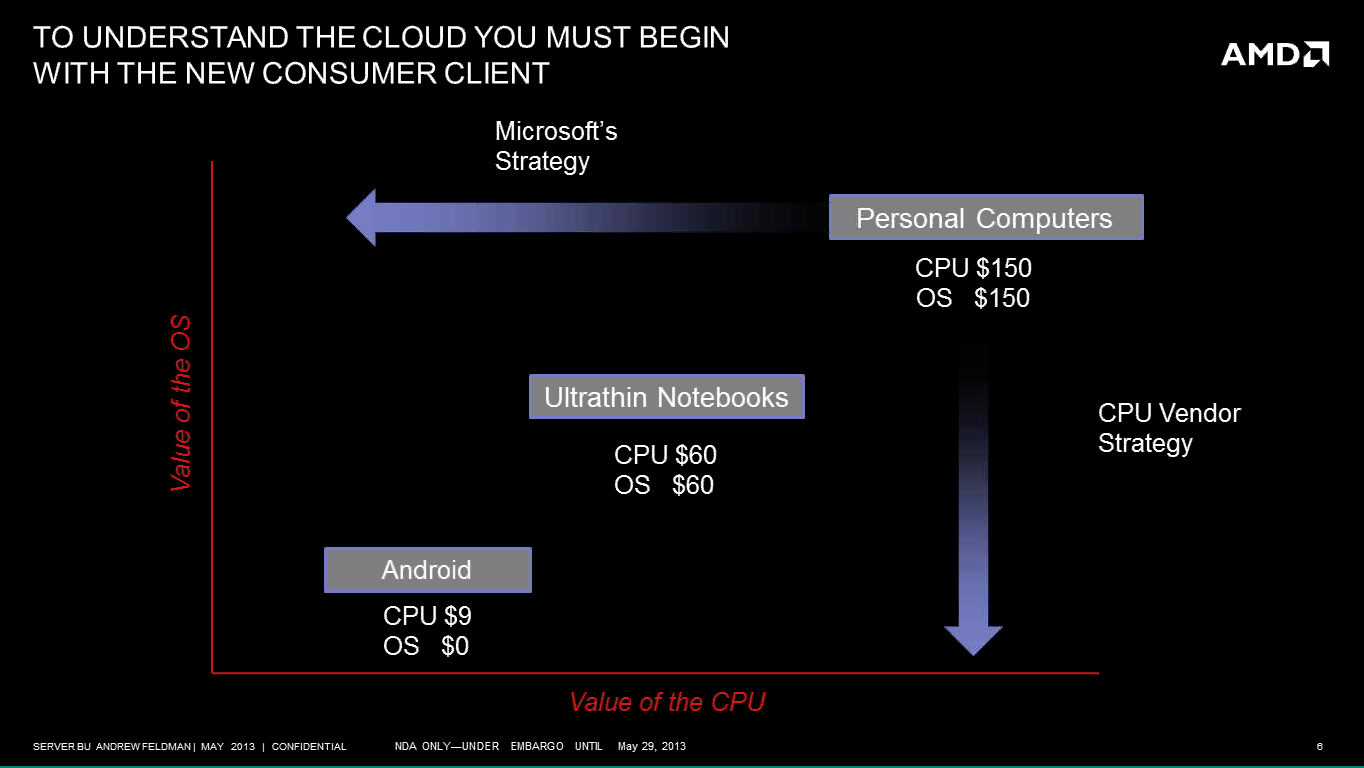

AMD envisions the Opteron X as a central component to the new cloud based datacenter. This is certainly in keeping with Rory Reed’s mobile focus for AMD. Feldman, Reed and others are banking on the massive surge in mobile computing that has happened over the last few years. They have watched as the mobile market exploded and cloud based services have started their major push. Many are seeing this shift in the consumer “compute” market, but not all are reacting to it the same way. For AMD they are focusing on developing to their strengths which means getting the GPU more integrated into the CPU for both the client and the server.

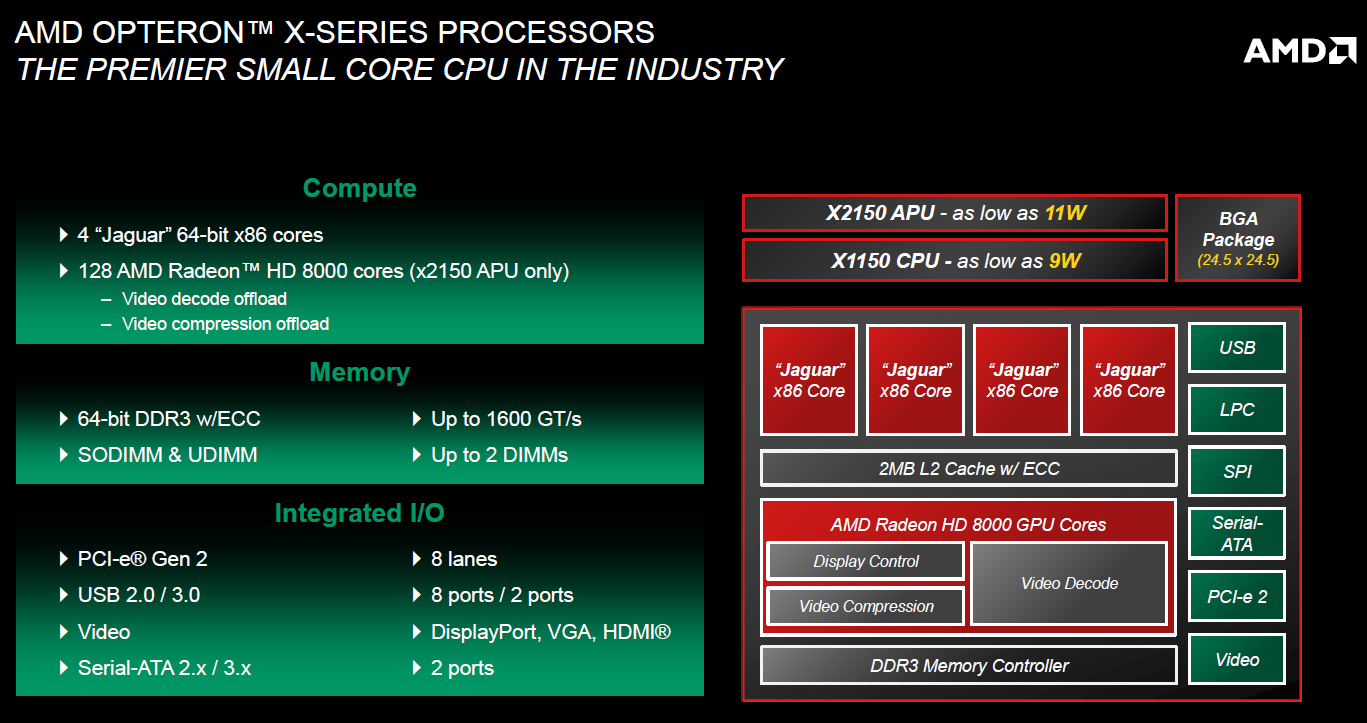

While the client side has been talked about until it has become just background noise, the server side has somehow slid off the map for some time. The environment has become stale with the same old systems running the show behind the curtain. AMD feels that the introduction of ARM and “small core” CPUs into the datacenter will change the way that corporations run their clouds. Instead of massive servers with 8+ CPU sockets, AMD and others are envisioning a world which is moving to smaller blade systems and 1U servers with one or two sockets. Kyoto is the first generation from AMD to fill that need and it is set to compete head to head with Intel’s S2100a Atom CPUs in the same space.

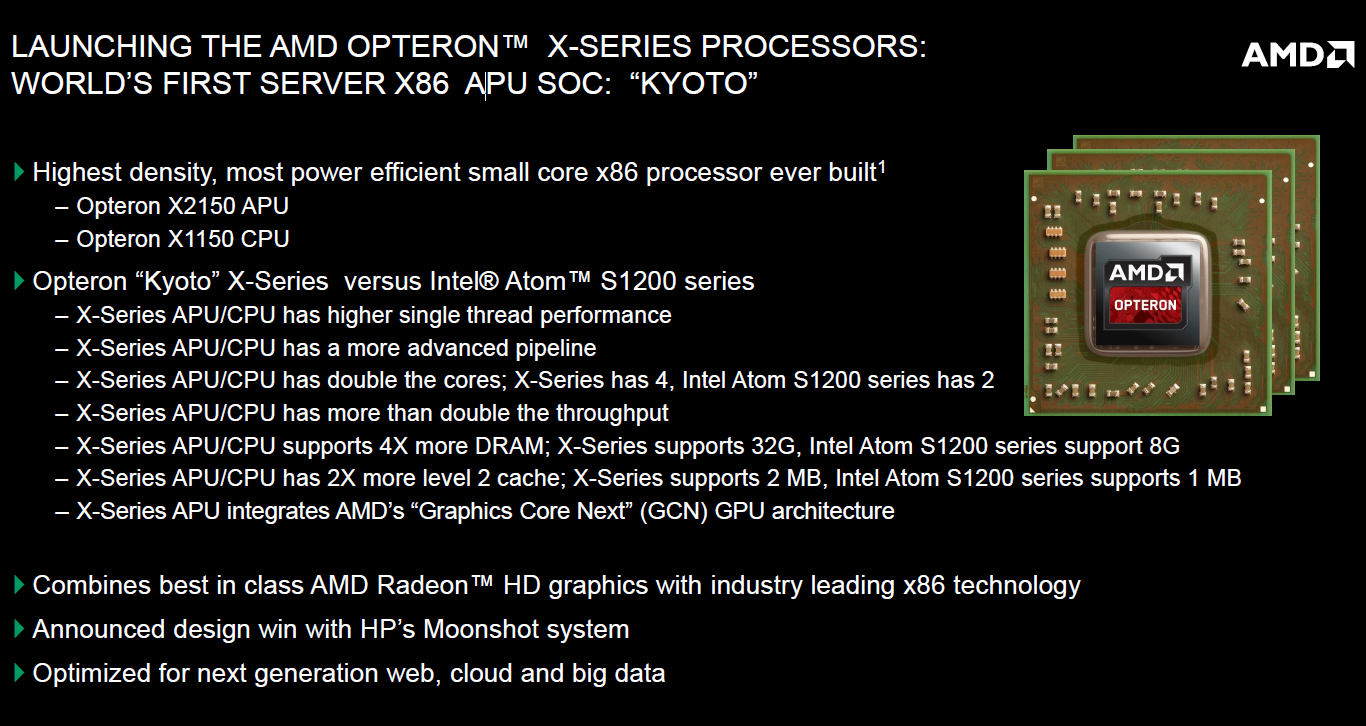

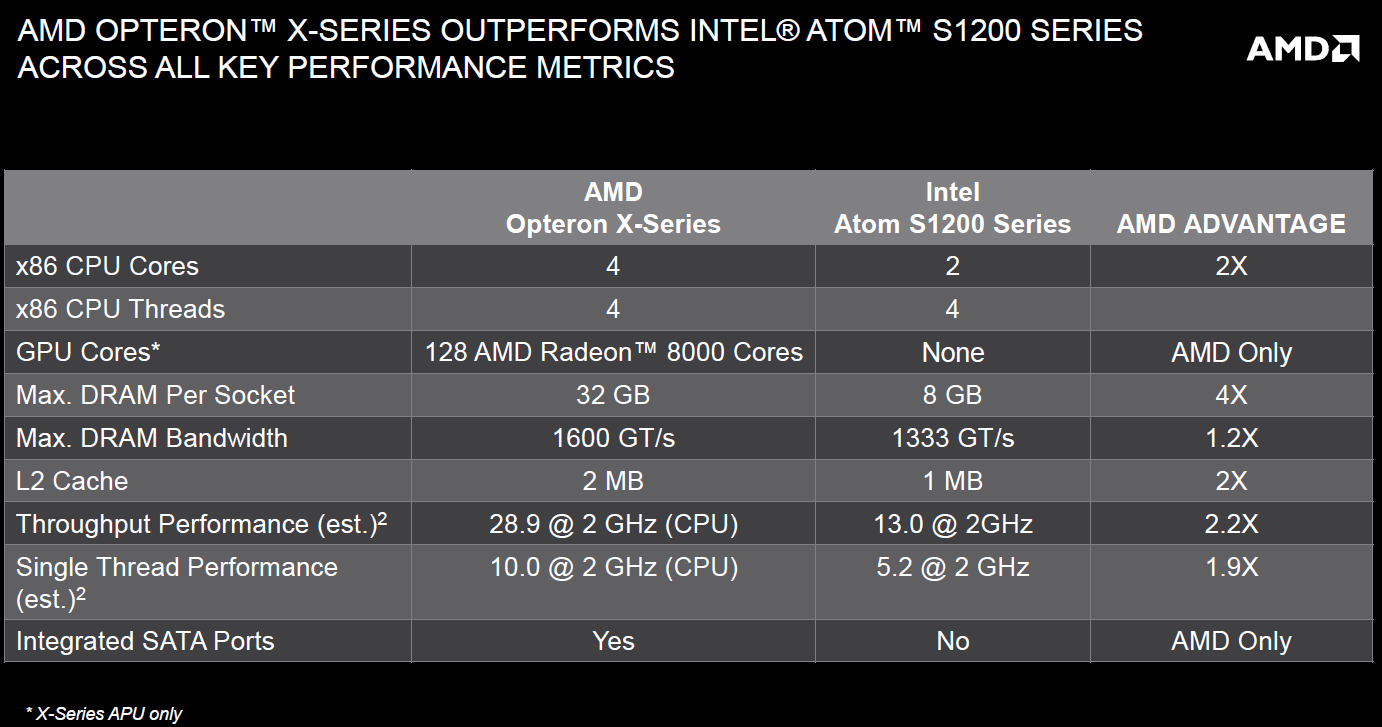

As we mentioned, AMD is going after Intel in this market to get in early and show what they can do. Looking at the Atom S2100, AMD sees an opening in Intel’s stronghold. They built Kyoto to push through that by addressing specific weaknesses in what Intel currently has on the table, and at a time before Intel can respond with their next product. As you can see in the slides below, AMD is hitting on addressable memory, number of cores, data throughput, and cache. The last item is interesting as AMD has had more than their share of issues in efficient cache and memory performance.

AMD’s Kyoto looks impressive compared to the S2100 Atom and the design specification is nice on paper. There are some things that we are a little surprised about though. AMD is only pushing PCIe Gen 2.0 on Kyoto. This is something that we are sure Intel will point out in their response as Intel is moving into PCIe Gen 3.0 in their CPUs rather quickly. Intel is also sure to mention that their newer Atom CPUs are a match for everything AMD is showing here with the possible exception of the graphics built into the Opteron X. This is where AMD holds a significant advantage over Intel and is part of what AMD hopes to leverage in their target market.

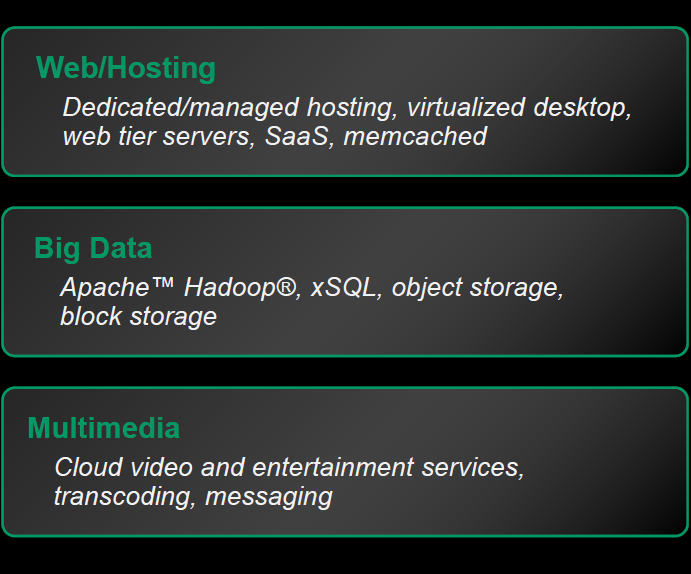

Speaking of target markets, just exactly where does AMD see the Opteron X going? For the most part, the new SoC appears to be geared toward desktop virtualization, web hosting, Software as a Service systems, as well as cloud video services (including transcoding). AMD is banking on cloud systems adopting the Opteron X for its performance and integrating them into their graphically heavy systems. What is surprising is that AMD also seems to feel that the Opteron X will work for big data where the SoC can work to sort, categorize, and tier data in the massive systems that need to run.

Looking over the list of target uses we see one very large thing missing. All of the uses listed above are for large scale operations. Small to medium enterprise customers are not included here in the usage model with the possible exception of desktop virtualization. Most of the other classes are large scale enterprise applications and are systems that make money from CPU time.

There are a couple of reasons for this omission. The first is that in the small to medium sized enterprise, the focus is more on infrastructure services and maintaining internal systems that support the business model: your CPU cycles are all about managing and maintaining your business and are not what brings in your income. The second reason is a much more pressing and important issue: licensing. Microsoft has (again) changed their licensing model and businesses are required to adapt to this new change, which has an increased cost. Building a system based on something like HP’s Moonshot would be exceptionally costly in terms of licensing if you are bound to Microsoft and VMware. Microsoft’s VDI licensing requires a license to install the desktop OS and another one to use it as a virtual desktop. This almost doubles the cost of the operating system for use with VDI systems like Xen Desktop and VMware View. If you are running SQL on a system like this then the cost is even higher, as Microsoft has moved to a per core licensing model that has driven up the cost of running core systems by as much as 300%!

Microsoft’s model is pushing the small-medium businesses into the cloud and the large scale enterprises are buying site licenses (or shifting to a form of Linux) while the small and medium sized enterprises are left holding the check. When we mentioned this to Andrew Feldman, he responded in tones that suggested he was aware of the situation and did not agree with the way Microsoft was moving. He did not go so far as to say this outright, but he did mention that many companies were already considering different Linux alternatives and that Microsoft was (and should be) concerned about the rise of systems like the Chromebook.

Licensing and infrastructure are two big areas that will keep the high-density small core servers from wide scale adoption for the foreseeable future. It leaves large to very large markets in the hands of AMD’s rival Intel, and it is a market that will probably not make the move to the new model anytime soon. This means that AMD has their work cut out for them in getting the large scale global enterprise companies to buy into their design philosophy. They can do this and drag some market share from Intel in the process, but they have to follow through and execute on the promises that the small core cluster brings to the table. The Kyoto must be followed by a more advanced and capable SoC to drive the market for AMD.

Unfortunately, this is one area that AMD has had problems with in the past. They can envision some amazing things, but their budget restrictions have often prevented them from bringing them to the world in a timely manner. There is also the possibility that the mobile computing and cloud will falter due to some glaring security issues that exist today at the client and datacenter level. If either of these things happen, AMD needs to be ready with a response that is just as decisive as Kyoto appears to be today.

What do you think about the Opteron X and its place in the market? Tell us in our Forum